One of the biggest advantages of CFO advisory services is gaining a clear, real-time understanding of your finances. Advisors translate complex financial data into actionable insights that founders can easily understand. Tech companies and SaaS startups operate in one of the fastest-moving and most competitive business environments today.

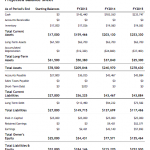

Cost Comparison & ROI

Our robust and flexible data pipelines are tailored to the unique needs of early- and growth-stage tech startups. Our approach combines deep financial expertise with smart automation to ensure your team can access clean, timely, and actionable data. These mistakes can lead to unnecessary costs, delayed funding rounds, and increased scrutiny from investors. Without proper financial systems, young companies may also struggle to provide reliable reporting to stakeholders, which can weaken trust and slow the pace of growth.

- This aligns with Ramp’s discussion on startup accounting, which highlights the scalability of outsourced solutions.

- Whether you’re securing your next round of funding or planning for future growth, our expert financial forecasting ensures that you’re always prepared for what’s next.

- Their expertise ensures accurate financial reporting and adherence to industry-specific regulations.

- With all these benefits, it’s no surprise that so many startups have emerged to innovate the world of matcha.

- Build Mode is a survival guide for early-stage founders navigating the messy, high-stakes chaos of building a company from scratch.

- Here are a few providers known for their work with startups, including their specializations and what they offer.

Key Metrics and Best Practices for Financial Health

We provide small business accounting services across Illinois, helping business owners stay focused for growth. Learn how Invensis enhanced the order management efficiency of an Australian home shopping company by providing efficient data processing outsourcing services. At Tech.co, we understand that tech decisions can make or break your company. Whether you’re looking to buy software that will level up your business, or want to understand the latest issues affecting your industry, you need experts who can give you the inside track. CFO advisory services allow founders to focus on product development and customer experience while maintaining confidence in their financial strategy. CFO advisory services ensure leadership focuses on meaningful KPIs rather than vanity metrics, improving decision-making across teams.

- They prepare accurate financial statements, projections, and investor-ready reports that increase credibility with investors.

- Maintain supporting records like bank statements, invoices, receipts, and payroll details.

- Startup accounting services help keep track of finances, monitor cash flow, make informed decisions, and comply with tax regulations.

- Starting a new business venture is an exciting, albeit challenging, journey filled with many responsibilities and decisions.

- This allows you to make decisions based on current data, not outdated reports.

Benefits of CFO Advisory Services for SaaS Startups

Choosing the right software Accounting Services for Startups: Enhance Your Financial Operations can significantly influence a startup’s success. Monthly recurring revenue (MRR) is a key financial metric for tech startups, providing insights into growth trajectory and overall sustainability. Tools such as QuickBooks, Xero, and FreshBooks are often favored for their user-friendly interfaces and robust reporting capabilities. These platforms provide comprehensive solutions that cater to the needs of various business sizes, from invoicing and expense tracking to advanced financial reporting.

Calling all startups & businesses…

- Ario is a Norfolk, Virginia-based company founded in 2016 by Jacob Galito.

- In startups, accounting is the process of recording, classifying, reporting, and summarizing financial transactions to provide financial information to make business decisions.

- We are rated among the best startup accounting service firms due to our wide exposure to customizing accounting for our clients.

- When done right, your finance function is a strategic weapon; when ignored, it can lead to cash flow crises and failed funding rounds.

- Through careful planning, we ensure that your startup takes advantage of available deductions, credits, and tax strategies to lower taxable income.

- As Y Combinator CFO Kirsty Nathoo notes, a messy or inequitable cap table is a red flag for investors.

- Look for conferences offering startup-focused sessions, expert speakers, networking opportunities, and practical accounting insights relevant to growing tech businesses.

When deciding between in-house and outsourced https://jt.org/accounting-services-for-startups-enhance-your-financial-operations/ accounting, carefully consider your specific needs and long-term goals. A hybrid approach, combining in-house staff with outsourced expertise for specialized tasks, might be the most effective solution. For expert tax planning and financial management tailored to your startup’s needs, connect with Clear Peak Accounting.

Financial Controller jobs

Their platform integrates with various tools to streamline financial management, making it easier for tech startups to maintain accurate records and gain insights into their financial performance. Solid financial planning and analysis (FP&A) is your startup’s roadmap to smart decision-making. Forecasting your future financial performance helps you secure funding, allocate resources effectively, and prepare for growth. Experienced accountants offer strategic guidance, ensuring your startup is ready for investment opportunities.